Finance & InsuranceThe Customer Service Conundrum of Open Banking

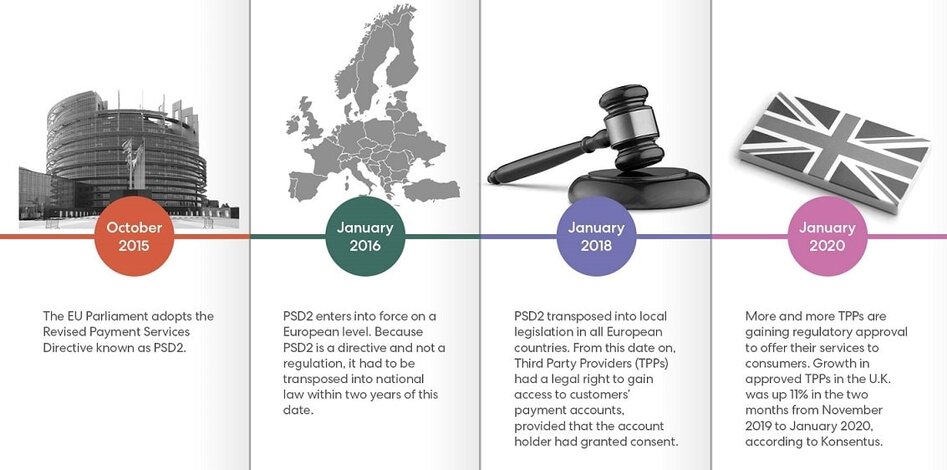

Europe’s revised Payment Services Directive (PSD2) is a rather complicated and comprehensive piece of legislation, but one aspect of it stands to shift the competitive landscape for financial services in Europe and beyond.

PSD2 requires all approximately 6,000 European banks to open up their customers’ payment accounts for Third-Party Providers (known as TPPs), who want to offer myriad financial services based on financial data, including real-time payment account data.

This new obligation for the banks, known as Access to Account (or XS2A), is a game changer both for the banking sector and for the emerging fintech industry. From now on, bank customers are in full control of their account data. The banks’ previous account data monopoly is broken, and the account holders can take advantage of any TPP service they find relevant and helpful.

Such TPP services may either be payment services from TPPs known as Payment Initiation Service Providers (PISPs) or pure data services from TPPs known as Account Information Service Providers (AISPs). An example of a PISP service could be that a consumer’s preferred e-commerce shop gets permission to draw money directly from the consumer’s bank account. AISPs offer accounting assistance for SMEs, fast credit scoring for lending, or budgeting tools for consumers or businesses.

Is all of this bad news for the banks? That depends on the bank. If banks refuse to act timely, they stand to lose. (McKinsey estimates that there’s $1 trillion in total economic profit globally that’s potentially up for grabs across sectors thanks to open APIs.) But, if banks embrace the opening of the market as an opportunity to collaborate with the best fintechs to offer their customers new and innovative services, they’ll likely be able to retain and possibly attract new customers.

And if they become TPPs themselves and start piggybacking on competing banks’ payment account data, they could be in a winning position and end up prospering significantly from Open Banking.

In the U.K. alone, 80.6 million Open Banking API requests were conducted in October 2019, according to London-based PSD2 experts Konsentus. Just two months later, that number had surged to 280.6 million.

More than 50 other countries are working on the implementation of open APIs in the financial industry, touching more than 10,000 banks, according to The Paypers Open Banking Report 2019.

“From what we’ve seen in our research, effects are even bigger,” the report notes. “87% of all countries now have some form of Open API activity, which leads us to the conclusion that Open Banking truly is a global phenomenon now!”

In the midst of this shift, one critical aspect has been largely left out of the international conversation on Open Banking: How do you ensure quality customer service in an open world? With potentially thousands of new TPPs accessing customer accounts, what are the ramifications for managing customer service for banks—as well as for the TPPs?

To comply with PSD2, EU banks must open up for the TPPs, provided that the account holders have given their consent. Although this is not yet mandated in other markets, such as the U.S., some customers already use third-party apps like Mint or Honeydue to access their financial data from their banks.

Are the banks’ customer service teams prepared for the coming influx of TPPs? Do they know what kind of questions to expect from the account holder—their customers? Do they need to become experts in all these other services? That seems unlikely, but they also don’t want to just tell their customers they can’t help either.

And what if something goes wrong?

If the TPP turns out to be fraudulent and cheats the account holder? In that case, the bank is liable, and the account holder will turn to the bank with lots of questions and claims.

Even though the bank didn’t invite the TPP to knock on its door; didn’t encourage it to engage with the bank’s customers; and didn’t have anything at all to do with the service offered by the TPP, the bank is still responsible, according to the regulation.

On the flip side, what about the many TPPs, who, for the most part, will be fairly young companies who might not yet have scalability-tested policies and procedures?

Before starting their Open Banking adventure, TPPs also need to think carefully about how to manage customer service. Capturing bank customers and offering them all kinds of fancy financial tools is just the beginning.

For staying power, you must be prepared to help those customers when they have questions or, worse, if something goes wrong. No matter how good you think you’ve designed your app or your customer journey, there will be questions. Consumers will need your help for something. And they might call you when they should be calling their bank, or vice versa.

How you handle those interactions can have lasting impacts on your brand and your ability to gain new customers. We’ve seen fintechs gain massive popularity seemingly overnight. That’s wonderful, as long as you’re ready for it.

Whether you handle customer service in-house or rely on outside partners, Open Banking and the influx of new services and tools at your customers’ fingertips has the potential to create an influx of customer queries. The most important thing is knowing how you’ll respond before the phone starts ringing, the chats start flooding your system or customers take to social media to air their grievances.

At the end of the day, Open Banking is going to increase competition. More than ever, your competitiveness will depend on your ability to make your customers happy.

Corey Besaw is the Chief Operating Officer at Ubiquity, where he leads the organization’s specialized dispute and chargeback management, fraud investigation and identity verification services. He has nearly 20 years of experience in customer service and operations for financial institutions and fintech firms.