The era of legacy approaches is waning as industries recognize that quick, trend-driven shifts aren't enough. Every sector faces upheaval from new disruptors, viral social phenomena, and the emergence of Web 3.0 technologies. These forces are uprooting established CX norms, signaling that the path to enduring success isn't a sprint but a strategic, long-term endeavor.

In this environment, brands are learning that the mastery of customer experience management is not just a play but a critical, ongoing journey. The cornerstone of enduring success in this relentless evolution hinges on understanding this:

The new players, the startups, and the innovators all have had a head start in taking change in stride and running with it. But the traditional players? They’re held back by:

Legacy Systems

Size-limited agility

Regulatory Challenges

Siloed teams

Entrenched processes

Old-world mindsets

What were once advantages—size, scale, even heritage—became liabilities.

And the transformation necessary to meet customers’ rising expectations (and shift from the old world to the new) doesn’t come easy.

The challenge is to reimagine old ways of working toward new ambitions.

Which means building a strong, symbiotic relationship between business process outsourcing and customer experience management.

The trouble is that it’s tempting for services brands to treat outsourcing and business transformation separately.

And that’s the wrong strategic move … because they’re now directly connected.

YOUR BUSINESS PROCESS OUTSOURCING STRATEGY PROBABLY LOOKS GOOD ON PAPER. IT’S WHEN STRATEGY CLASHES WITH REALITY THAT YOU LOSE GROUND.

If your investment in business process outsourcing goes for lower costs above all else, you may get a quick win or two in the short term. But in the long term, you’re losing ground because:

You’re chipping away at your customer’s trust in you (when they encounter friction and frustration as a result of cut corners)

You’re doing damage to your brand (word spreads fast that your hold times are long and you can’t solve problems like your competition)

and you’re creating more costs and using more resources from other business areas to make up for expedience (and nobody wants to be responsible for that)

WE CALL THIS THINKING

“Old-school transactional outsourcing”

But because we account for every last factor in CX management, you can see everything, eliminate doubt, scale with ease, and Outsource Fearlessly. Instead of just lower costs, we optimize service to deliver longer customer lifetime value, a better return on outsourcing (ROO), while accelerating your transformational goals over time.

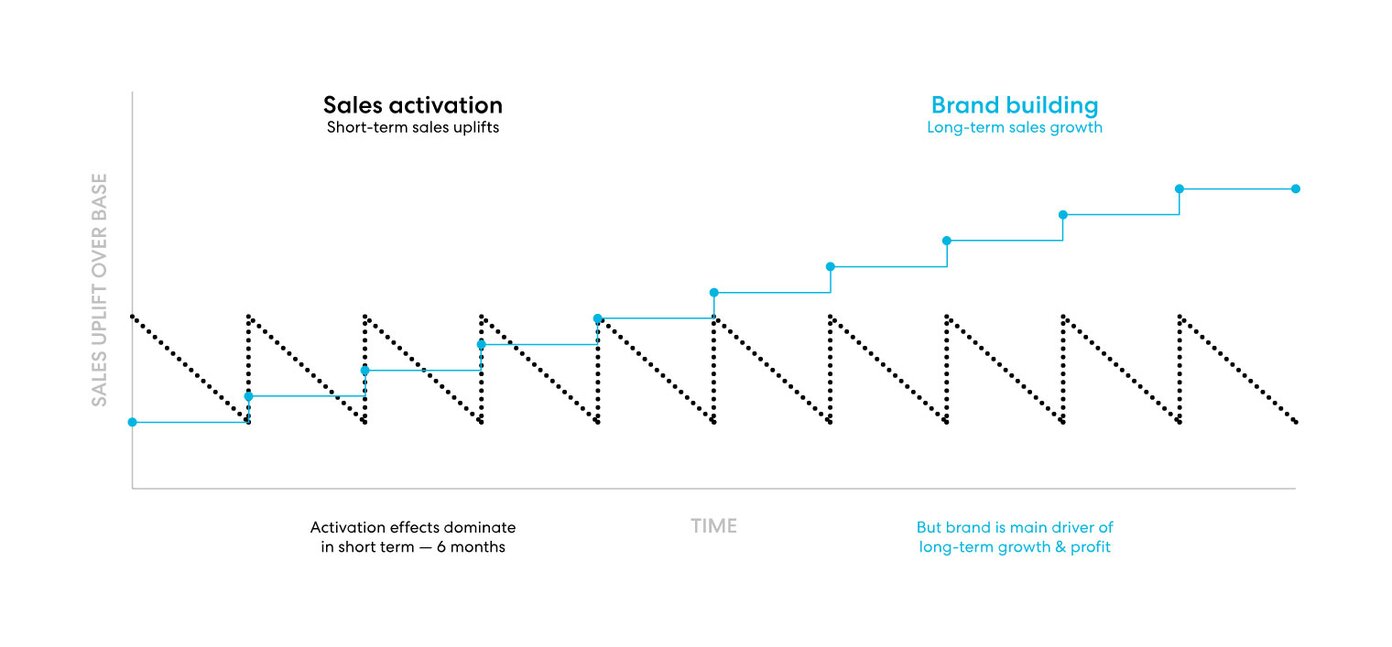

Have you seen that popular chart comparing quick sales hikes to steady brand building? It looks something like this…

In the long term, it’s ineffective—and it will harm your brand’s reputation. Customers will question your value.

Conversely, committing to steady, long-term investments in service gets you higher rewards (and more sales) over time. Outsourcing grounded in exceptional customer experience gives you wins day after day as you garner loyalty and nurture advocacy, built on a foundation of customer value.

CAN’T WAIT TO SEE HOW TO REMOVE DOUBT AND OUTSOURCE FEARLESSLY? LET’S TALK.

However, CX management is not just about digital-only, self-service channels and behaviors.

And business process outsourcing that’s too focused on minimizing human connections misses the mark.

What happens when your customer has a request that can’t be handled by self-service? What if your customer needs reassurance or empathy that no robot can bring? (Robots: We still love you, but you can’t do everything.)

Deposit and withdraw money through your mobile app rather than your local branch

Verify your identity with your face instead of a government-issued ID

Monitor financial transactions on your own time, not your broker’s time

But that doesn’t mean it has to be complex, costly, or time-consuming. And there are many critical CX moments that benefit immensely from a human touch:

Ask yourself: Will your customers tell their friends about a faceless interface that left them stranded or about the kindness of a real person who helped them in a jam instead?

Cutting costs often closes the door on opportunities for great customer experiences that keep customers coming back.

Instead, you need smart integration between digital streamlining and live support.

Where old-school, transactional outsourcing doesn’t account for real-world complexity (and so delivers subpar CX), the Ubiquity CX-first way puts fruitful human connections back into the outsourcing equation.

Our bespoke, agile methodology is built on decades of experience supporting and partnering with services challenger brands as they ramp up.

Legacy services firms needed to change. And fast. What were once advantages—size, scale, even heritage—became liabilities.

We focus on outsourcing’s critical processes so our specialists and process experts can work quickly (and error-free) in the places they’ll have the greatest impact.

Extensive onboarding

Rigorous training

Account Management

Long-term strategy ideation

Rigorous yet flexible processes

Comprehensive compliance

Employee development, engagement, & retention

Deliver on business goals reliably

Resolve pressing CX demands, worry-free

Reduce friction, churn, and costs per customer

Build stronger loyalty for greater lifetime value

Discover how CX wins impact your bottom line

AND SUCCESSES BUILD ON SUCCESSES OVER TIME. THAT’S HOW TO PLAY THE OUTSOURCING GAME TO WIN, AND REAP A SOLID RETURN ON OUTSOURCING.

(If you said transactional, maybe scroll back up and read again).

With CX-first, you deliver better experiences and reap an ROI on your outsourcing (handy ROI Calculator here).

Build lasting customer value—and advocacy—by investing in relationships with your customers.

To provide the best experiences, we use technologies like cookies to store and/or access device information. Consenting to these technologies will enable us to process data such as browsing behavior or unique IDs on this site. Not consenting or withdrawing consent may adversely affect certain features and functions.