Neobanks and digital challengers can come through the pandemic stronger if they double down on what they do best—deliver great customer experiences. Find out more from Ubiquity's Innovation Day 2020 presentation.

By Corey Besaw, Ubiquity

Watch Customer Experienced Reimagined at the Prepaid International Forum’s Innovation Day 2020.

Neobanks and digital challengers double down

Neobanks and digital challengers can come through the pandemic stronger if they double down on what they do best—deliver great customer experiences.

2020 has created a whole new set of challenges and opportunities for digital banks and prepaid providers—and for those of us who manage their customer support.

Challenger banks have gained popularity over the past decade-plus, in large part, because they provide a better digital experience than traditional banks. This moment is a tremendous opportunity to double down on that foundation. By continuing to offer a more seamless experience at onboarding and faster resolution when customers need help, digital banks can build customer relationships that last.

Customer expectations: Don’t make us wait

Consumers were a little more understanding about wait times when lockdowns first began back in March. But as hold times stretched to hours or even days for some large financial institutions, customer frustrations began to boil over. If there was ever a time when consumers needed reassurance about their finances, this moment continues to be it. And now that organizations have had months to adapt, customers are right to expect better from their financial services provider.

Customer frustrations notwithstanding, we haven’t exactly seen an exodus from major banks in 2020. And some experts have argued that in times of crisis, big banks that have been around for decades have an edge when it comes to consumer trust. Some analysts have gone so far as to proclaim the demise of Europe’s neobanks.

It’s true that the economic realities of the pandemic, including lower consumer spend, have put increasing pressure on revenue models that rely on interchange. However, we’ve also seen digital banks moving from an ancillary service to a primary banking relationship.

Challenger bank momentum

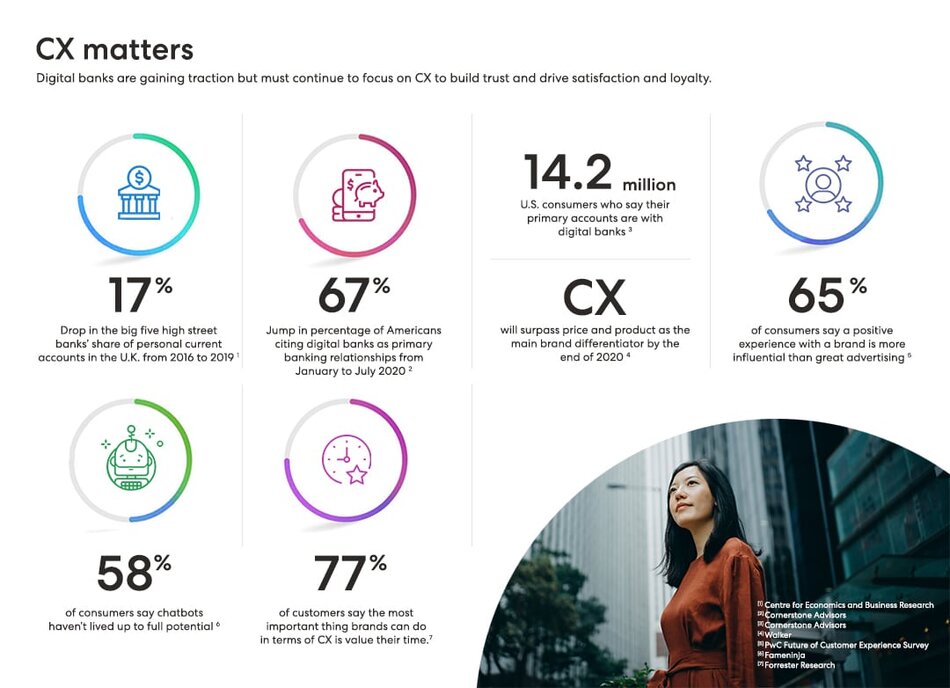

Great CX has been at the core of the value proposition for digital banks and prepaid providers in the U.S. and across the U.K. and Europe.

It’s taken several years, but challengers are starting to become more than complementary services for customers who maintain their primary accounts with large banks. And while there’s still significant space to increase market share, progress has been swift this year.

Research released in July from Cornerstone Advisors found that 14.2 million Americans—6% of U.S. adults with a checking account—now consider a digital bank to be their primary bank. While still small compared to the market share of the big banks, that figure represents a 67% jump from January 2020.

If you look at the number of primary bank customers (4.3 million), that would make Chime a top 10 U.S. bank. Similarly, in the U.K., the big five high street banks’ share of primary accounts has diminished considerably since 2016, falling from 80% to 63% in 2019.

Digital-First Surge

As consumers flocked to digital channels out of necessity during the pandemic, large financial institutions accelerated their digital transformation strategies. At the same time, we’ve seen challengers launching new features like cryptocurrency exchange, enabling donations to pandemic relief or local businesses, and linked junior accounts for kids. Chime announced in April that it would advance 100,000 accountholders up to $200 of stimulus relief funds prior to deposit.

When it comes to consumer trust, it may seem logical that consumers would feel more comfortable with older brands. However, when you dig deeper into customer sentiment data, you’ll find that even though consumer trust reportedly dropped three times faster for challengers compared with high street banks between January and March in the U.K., challengers are still viewed far more favorably. On a scale of -100 to 100, high-street banks had, and continue to have, a much lower overall sentiment (-13% vs -35% currently).

While the pandemic has required businesses of all kinds to review their revenue models, I believe digital banks have a significant opportunity to double down on what they do best—pivot and provide great CX—and come out of the crisis stronger.

Corey Besaw is a Ubiquity co-founder and president of Banking Operations, where he oversees dispute and chargeback management, fraud investigation and identity verification services. This article is an excerpt of his presentation at the Prepaid International Forum’s Innovation Day 2020.

To provide the best experiences, we use technologies like cookies to store and/or access device information. Consenting to these technologies will enable us to process data such as browsing behavior or unique IDs on this site. Not consenting or withdrawing consent may adversely affect certain features and functions.