Next-generation cards and payments company selects the No. 1 business process outsourcer (BPO) for fintech to provide white-label customer service and dispute and chargeback management for Apto's embedded finance and fintech clients.

Leading fintech BPO to provide white-label customer service and dispute and chargeback resolution services

LAS VEGAS, NV / October 24, 2022 / Apto Payments, a next-generation cards and payments company, today announced its partnership with Ubiquity, the leading business process outsourcer (BPO) for fintech, to provide white-label customer service and dispute and chargeback resolution services to Apto’s clients.

Apto Payments, whose card issuing platform enables businesses to design and build corporate, disbursement, loyalty, neobank, and crypto cards in hours rather than months, selected Ubiquity because of the company’s fintech experience, compliance acumen, and track record of helping challenger brands scale exceptional customer experience (CX) cost-effectively.

The partnership comes as businesses face high inflation, difficulty in recruiting and retaining staff, and a dramatic decrease in funding that has put even more pressure on fintechs to achieve profitability quickly. In Q2 2022, global fintech funding dropped to its lowest level ($20.4 billion) since Q4 2020, according to CB Insights. CX management is critical to profitability and long-term business sustainability because when done well, you can reduce servicing costs per cardholder while driving the kind of CX that keeps customers coming back.

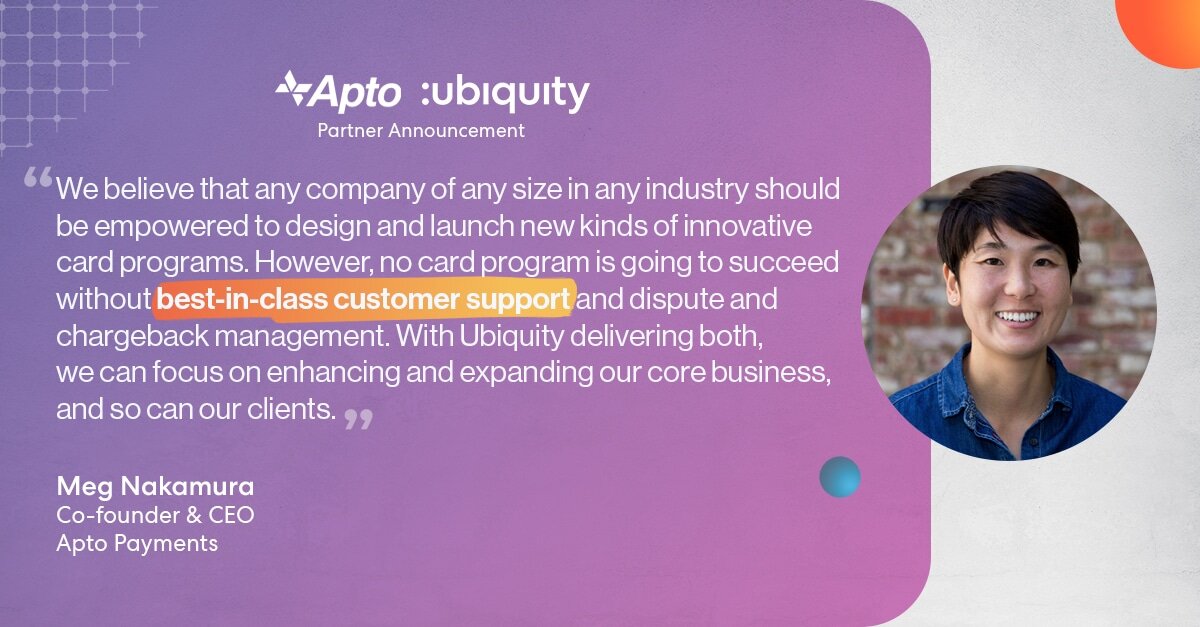

“We believe that any company of any size in any industry should be empowered to design and launch new kinds of innovative card programs,” said Meg Nakamura, co-founder and CEO of Apto Payments. “However, no card program is going to succeed without best-in-class customer support and dispute and chargeback management. With Ubiquity delivering both, we can focus on enhancing and expanding our core business, and so can our clients.”

“Ubiquity was founded to provide fintechs with higher quality customer support and compliant banking operations at scale,” said Peg Johnson, SVP of fintech for Ubiquity. “By partnering with an innovator like Apto Payments, whose expertise in compliance and regulatory matters aligns with Ubiquity’s, we can deliver on that promise. Together, we are raising the bar for what clients can expect from their processing partners and what customers can expect from their card providers.”

Fintech BPO benefits for your business.

To provide the best experiences, we use technologies like cookies to store and/or access device information. Consenting to these technologies will enable us to process data such as browsing behavior or unique IDs on this site. Not consenting or withdrawing consent may adversely affect certain features and functions.