Fast-growing fintech talks to Ubiquity about scaling exceptional customer experiences for low-income households while improving financial health.

For Propel, building trust is more important for exceptional customer experience than average handle time or encouraging customers to self-serve.

In fact, the company wants customers to call. That’s because customer conversations give Propel an opportunity to deliver the type of customer experiences that foster lasting relationships while also gleaning invaluable customer insights.

On the heels of a $50 million Series B fundraise in March, Propel announced a partnership with the White House in May to help low-income households access free, high-speed internet packages. It’s another major milestone for the Brooklyn-based technology company whose mission is to build modern, respectful, effective technology that helps low-income Americans improve their financial health.

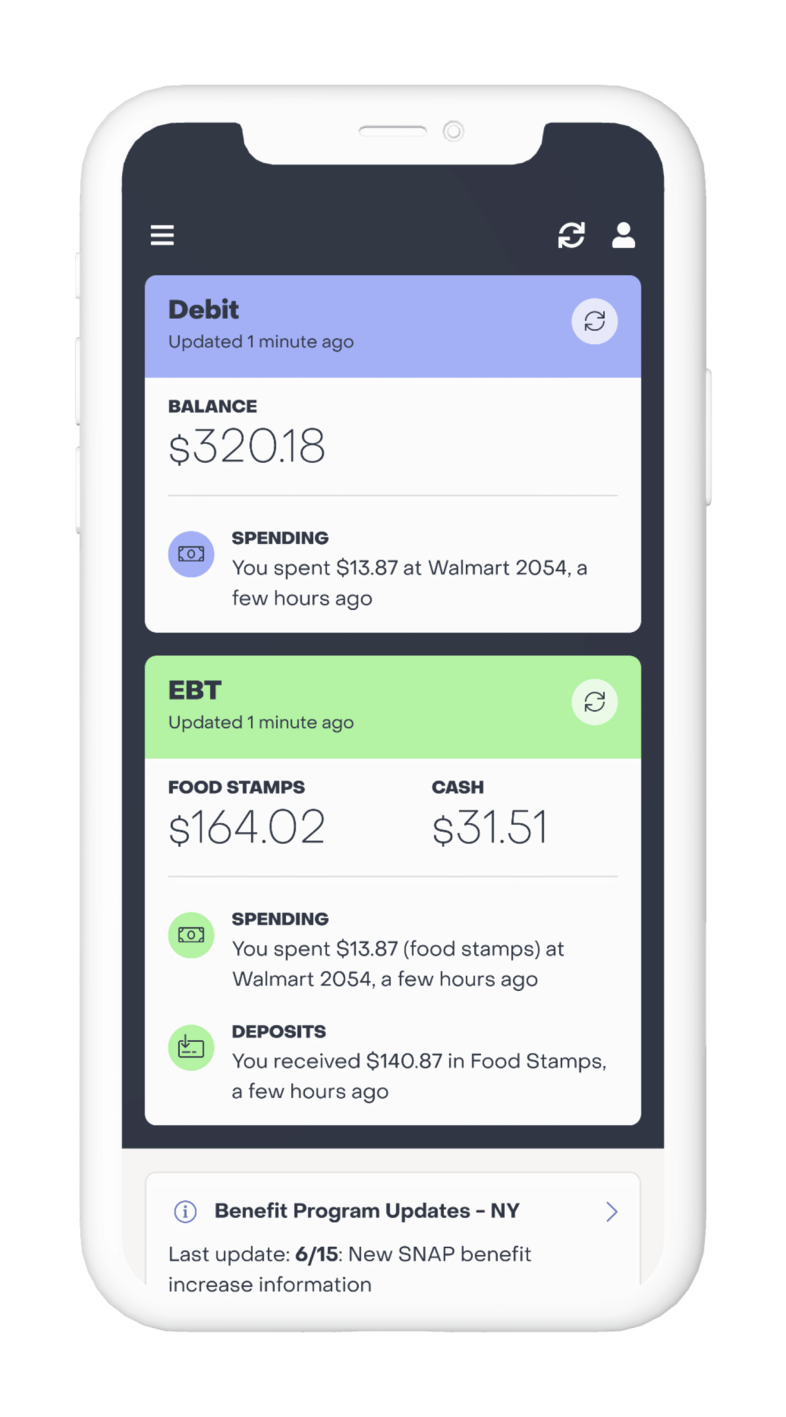

About 5 million government benefits recipients use the company’s Providers app to manage their benefits and other income sources, access discounts, and search for job opportunities. The companion Providers debit card also enables access to direct deposit up to three days early and to some government benefits up to five days early.

Ubiquity sat down with Propel’s Head of Debit Operations Mike Garris to talk about the company’s strategy for delivering great CX at scale and the importance of true empathy and really listening to customers.

Ubiquity: When you think about CX for your specific customer base, what’s most important to you? Is it different from serving other demographics?

Mike Garris: When it comes to CX for a financial services product, there are certain fundamentals for any demographic. You have to accurately solve someone’s problem, so showing good listening, identifying the need, and following the process to solve their problem.

We’re focused on low-income Americans; the entry point for our app is that you’re receiving food stamps. About 70 percent of our active customers are moms, and there are a lot of sensitivities around their finances. Our task as a company and as customer service representatives is to solve their problems and make things a little bit easier for them. Small errors, small fees, small delays can mean the difference between shopping for food that day or not.

With that kind of emotional charge and urgency, the importance of being accurate is a little more tuned up for us. Our customer service agents need to not only be very customer-centric and figure out the most expedient way of solving that problem, but they also need to show that patience, that empathy, and understanding that a $3 ATM charge is a big deal.

We over-index on empathy and really good execution, but it’s also complementary to the CX that the product needs to work really well. We’re very focused on small bugs, small inefficiencies. We have a very robust circular feedback process with our product team because a small thing that’s not working right could have big effects on our customers. We want to be preventative in people calling us for reasons that we don’t want them to call us. But there are a lot of reasons we are okay with them calling us.

Expertise and empathy on call

Our CX team has learned a lot; we’ve become experts in the way government benefits work—the timeline, what days of the month they’re gonna come in, how they show up, how early direct deposit for government benefits specifically plays out. It’s an advantage for us as a company that when someone’s talking about an issue with their state administrator for their food stamps, our CX team is following what they’re talking about. We don’t solve their food stamp problem, but we can help walk through what next steps they should be taking.

Meet Propel

Founder: Jimmy Chen

Location: Brooklyn

What they do: Propel’s mission is to enable Americans with low income to improve their financial health. Propel’s free app, Providers, is used by more than 5 million Americans across the country each month to manage their government benefits. In July 2021, the company launched a companion Providers debit card.

Funding: Propel raised $50 million in a Series B round led by Nyca Partners, joined by other investors including JPMorgan Chase, Salesforce Ventures, and Andreessen Horowitz. This round’s capital infusion brings the startup’s total funding to $80 million since its Series A in 2018.

Impact:

SNAP (formerly food stamps) benefits last 2 days longer per month when using the Providers app

375,000 Americans have enrolled in Lifeline and received a free smartphone through the Providers app since the start of the COVID-19 pandemic in March 2020

$60M+ saved through coupons featured on the app

200,000+ job applications submitted

14,000 households receiving discounted home Internet

4,500+ Medicaid applications

Ubiquity: Tell me more about empathy. How do you operationalize something like that?

MG: Empathy is huge for us, and we communicate that from day one. Fortunately, the people we work with at Ubiquity have experience with analogous products and similar demographics. And so early on in our planning, we talked about the importance of empathy in our customer experience. It starts with hiring the right type of people internally and at Ubiquity, and then how they’re trained.

When it comes to one thing you want to prioritize—in our case, empathy—there’s always that converse. What are you giving up a little bit to do that? We’ve been clear that handle time or other typical call center metrics aren’t as important to us. We’re not saying we’re indifferent to them, but empathy comes first, and the quality of your interactions should come first. We want the customers walking away feeling confident with their experience, our product, as well as the people they’re talking to.

One way to operationalize this is identifying things that might get in the way of your agents actually solving customer problems. Sometimes the leadership can introduce things that actually inhibit agents from solving problems quickly and with empathy.

One other thing we’re doing to really underscore our ability to relate to our customers from a CX perspective is to supplement the offshore Ubiquity team with an internal CX team with lived experiences that look like our customers’ experiences. Some of our agents have experience on food stamps or Disability or Social Security benefits, or as parents who receive benefits; they know what our customers are going through.

Ubiquity: What is the biggest challenge in operationalizing empathy?

MG: I listen to a lot of calls, and there’s redundancy in the call type and that can be a challenge for agents because they’ve answered someone’s question about the timing of their deposit a thousand times already. And so the risk really is how do you make the agent feel like this is their first time answering that question for the customer? The challenge is giving the agents a good work experience, which Ubiquity helps us to do. Supporting anything that the agents need, anything that will help their engagement—whether it’s a pizza party or recognition. It’s a very difficult job, and agents need to be happy with their environment.

Ubiquity: You talked about hiring people who have experience with government benefits. Do they share their experiences with the other agents; does their knowledge inform training?

MG: Exactly, yes. So our hope is that this group is gonna be very helpful for the Ubiquity team because they have life experience with the app and life experience similar to our user base. They know some things I don’t even know. Every single one of our calls is recorded, and we use that for training. We focus a lot on call listening. And we think we’re going to get some new types of sample calls coming from this internal team.

Differentiating your fintech business

Ubiquity: Let’s shift gears a little bit to the wider industry. Many tech and fintech companies focus on higher income individuals, but there is a long prepaid tradition focused on serving underserved consumers. How is Propel different?

MG: We’re not in the business of selling a debit product. We’re in the business of solving problems for low-income Americans. We have a diversity of offerings, one of which is a debit product. We have a Benefits Hub, which is an education center for benefits. We have a job board. We have partnerships with mobile phone companies to get discount deals on cell phone plans that are subsidized by the government. And then we help users manage their food stamp benefits. Our plan is to continue expanding our offerings in addition to the debit product. We’re more of a supermarket, if you will, for tech-related and financial-related needs for this population.

Ubiquity: How does technology play into your strategy for delivering great CX?

MG: We’re pretty focused on insights and identifying problems that help us understand what’s happening with our users and what their needs are. So even on CX, we’re over-indexing our investments on tools that help us gain insight. For example, we recently deployed Stella, which is a platform for surveying customers. We’re using it now for our QA process. It’s really helped us gain insights for the product team and understand where we can do better on CX.

We went there as opposed to investing in some strategy to deflect phone calls or enhance self-service. That’s really not a priority for us right now. We want to learn about our customers. Often CX investments are about ‘How do I reduce my manual labor?’ ‘How do I reduce calls or make them more efficient?”

I’m not interested in that. I want customers to call us even though it’s less efficient. We’re here to serve this population and strengthen our relationship with them. And I’m proud of the agents we have; I want these agents to interact with users because those users will have better engagement. We definitely notice a correlation between frequent contacts with the CX team and using our product.

Doing more with data

Ubiquity: You’re dealing with a lot of data. How do you pull out the actionable insights?

MG: There are two components of getting insights from CX. One is the macro; you have to create well-organized reason codes. We’ve overhauled our reason codes a couple of times, so we’re being as precise as possible about understanding the trends for different core reasons customers call us. That’s helpful for understanding frequency and directionality, but I don’t think anything quite replaces listening to actual calls. You get to the deeper reasons of why they’re asking a question. You find out, for example, their card didn’t arrive or there are issues with the mailers, and then that insight allows me to go to the card manufacturer to troubleshoot. Call listening is better at getting to the net root cause for customer issues.

Ubiquity: How much time do you spend listening to calls?

MG: Ubiquity has a QA team, and we have a QA team. In addition to the work those teams do, we probably have about four hours of meetings a week in which we’re doing call listening.

Ubiquity: Can you give some examples of what you’ve learned from those calls?

MG: I’ve learned that our particular user base values support interactions as part of the product and service offering. They value talking to a human and feel reassured that when they call, someone picks up. It’s not just a robot every time; and that’s, in a way, part of the product.

We don’t want to avoid contacts. It can be expensive. But we’re playing the long game, so we’re okay with it. It’s an investment. A lot of tech companies just want to solve everything through tech. And I’m not saying that Propel doesn’t, but we’re a little more user-focused as opposed to just saying, “Hey, no matter what the issue is, we want to come up with an engineering solution for it.” We are a tech company, but we’re not gonna do tech for tech’s sake. We’re going to solve problems for customers in whatever way is best.

“I'm proud of the agents we have; I want them to interact with users because those users will have better engagement. We definitely notice a correlations between frequent contacts with the CX team and using our product.”

Mike Garris

Head of Debit Operations, PropelWhat it takes to scale

Ubiquity: Given your experience in fintech throughout your career, what’s your advice for scaling great CX?

MG: Fintech is a hard business. I’ve been at four fintechs where I’ve been someone in operations who’s helped scale the business. Your team organization becomes pretty important as your company grows and you’re creating more specialization. When you get good people to focus on specific problems and then you give them freedom to do what they’re going to be good at, that’s really powerful. But you have to start out with a structure that’s focused on a process or a problem, then build the team organization around it.

And then, especially if you’re hiring or managing appropriately, it’s amazing what talented people can accomplish with the right kinds of support. Each additional layer of scale as you bring on more people, you’re just trying to get more specialized in what problems you’re solving.

Ubiquity: What about communication as you expand? How do you collaborate without spending all your time in meetings?

MG: Two things: If you organize your teams around problems correctly, then you try to minimize their dependency on other teams. They themselves can solve as much of this or take it pretty far without having to interact a ton. Eventually, you’ll come to the size where that’s not possible. But if you find yourself in a lot of meetings, that could be an indication that your people aren’t empowered, or they’re not stacked up against problems and organized in the right way.

Teams should be pretty self-reliant; however, some meetings are inevitable. At Propel, we force a lot of articulation. If there’s a strategy you want to pursue, you need to write that down in detail and it’ll be reviewed asynchronously. So there’s a lot of pre-work before our meetings.

In regards to CX, there are two things I would caution. One is there’s not a one-size-fits-all approach. Apple should approach CX very differently than Propel, versus any other company. What you need to do is understand the business model and the strategy at your company, understand the culture and the values, and then develop CX that fits well within that—whether empathy is important, whether efficiency is important. All these different micro decisions should be consistent with the brand, values, and strategy. It’s a mistake to come in as a CX leader and say, “I did it this way in my last company, so I’m going to do it the same way.” The best CX is the one that feels and reflects other components of the way the company operates. It’s a little bit of an art.

The other thing I see some CX leaders do is getting a little caught up with metrics and adding in complexity—especially if they’re going from a larger company into a smaller one. If you over-engineer your CX or are flooded with metrics and capacity models and all that, you can lose focus on just effectively solving customer problems.

Only add complexity when you’re ready for it. And there’s definitely a need, but be a little cautious with being a perfectionist with a lot of metrics and sort of getting complicated and fancy with your CX as opposed to starting with, “What is the customer need?”

Ubiquity: Mike, thanks for your time today. Anything else you’d like people to know?

MG: I would just express appreciation for Ubiquity and for the agents who talk to our customers every day. It’s a hard job. Customers can be upset, and this is a human job. It’s not solving problems in the abstract. It’s solving real problems for people, with people.

Finding the right team at Ubiquity has been key in keeping this a human experience—taking care of our customers and the agents. That’s what this is really about. My job is to make sure the agents know they’re appreciated and that they are set up for success.

To provide the best experiences, we use technologies like cookies to store and/or access device information. Consenting to these technologies will enable us to process data such as browsing behavior or unique IDs on this site. Not consenting or withdrawing consent may adversely affect certain features and functions.