TASC's Director of Customer Experience talks about the vision and tech behind their universal benefits platform, which is transforming CX and helping them respond to COVID-19.

“The simple interface belies a lot of great functionality underneath-but for [users], it means they have quick access to information and their money”

Manj Muthukumaresan

Director of Customer Experience, TASCIn this installment of our CX Innovators blog, TASC’s Director of Customer Experience talks about the vision and tech behind their universal benefits platform, which is transforming CX and helping them respond rapidly to COVID-19.

Making tax-advantaged employee benefit accounts easy to use is critical to driving adoption, usage and retention. For Madison, Wis.-based Total Administrative Services Corp. (TASC), the nation’s largest privately held third-party benefits administrator, investing in that mandate culminated in the launch of their Universal Benefit Account (UBA) last April.

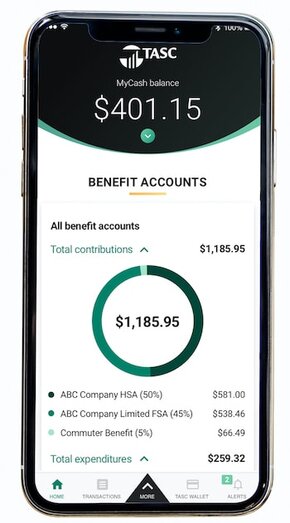

To create a simpler way to manage benefit accounts including flexible spending accounts (FSAs) and health savings accounts (HSAs), educational reimbursement accounts and workplace giving, TASC now offers one card, one mobile app, one website and one sign in for all accounts.

Ubiquity sat down with TASC’s Director of Customer Experience Manj Muthukumaresan to talk about how creating a “right-touch” user experience and a configurable platform has improved CX and made it easier to respond to customer needs amid COVID-19.

Ubiquity: Why is customer experience (CX) so important to TASC?

Manj Muthukumaresan: We pride ourselves on providing the right experience for each customer—and each customer is different. Some customers prefer more hand-holding, some prefer to serve themselves. Creating an experience that can flex to the distinct and different customer needs means that we’re delivering right-touch services rather than a one-size-fits-all experience.

U: Was that the impetus for your UBA platform?

MM: Absolutely. Our CEO had a clear vision—to delight our participants by making the experience easy, useful and intuitive. We designed the omnichannel experience to have a consistent and unified experience (website, mobile, card, customer care). We also improved the client experience by enabling them to serve their employees well and easily.

Every piece of the UBA had guiding principles driving the design and build. We addressed such problems as: simple and fast access to information (including account balances and notifications), secure but quick and easy access (leveraging biometrics mobile technology), card decline protection so they wouldn’t have a transaction refused and more. We also added solutions for things that we knew took valuable time for them in other platforms. For example, users now can take a picture of a bill and we pay it for them from their account. Or the ability to take a picture of a receipt as proof of purchase when they request reimbursement.

For the employer, building the platform without silos for each product—recognizing the common functions across various benefits—means that we can create new and respond to legislative changes faster than any other benefit provider out there. In fact, we added several new accounts to help employers help employees during this global pandemic and beyond.

U: Being fast and flexible is always our goal for customer support, too. And, that’s become even more important during COVID-19. Can you tell us more about how your platform’s capabilities influenced your pandemic response?

MM: The universal nature of the platform allowed us to launch more than a dozen new offerings in response to COVID-19 in two weeks’ time. This is unheard of in our industry. Our TASCResponds.com website is intended to share our expertise with the business community during these uncertain times. We have responded to more than 14,000 people—educating, informing and counseling on benefits due to the COVID-19 pandemic.

We also made our Emergency Benefit Accounts available at no cost for clients as well as non-clients in our local Dane County. We can assist in the account and plan details for self-administration or working with another service provider. Basically, we wanted to make sure employers could help employees with a variety of unexpected costs. One of the accounts is an Emergency Expense Reimbursement Account, which covers unforeseen expenses during difficult circumstances, including medical expenses, medical testing and treatments, as well as dependent care costs. We also launched an Employee Crisis Fund Account to provide grants to qualified employees facing financial hardship from a personal, regional or national crisis.

U: Let’s go back to the UBA platform more broadly. How have clients and end users responded?

MM: Participants like the ease of use—seeing information right up front, whether on the mobile app or online. The simple interface belies a lot of great functionality underneath—but for them, it means they have quick access to information and their money. Employers see that their employees aren’t calling as much because they understand how to use the tool and get what they want when they need it. That means HR can focus on other pressing areas rather than handling benefit questions. The mobile app has really simplified things for employees as well, and we’ve seen even more positive reviews as we’ve made responsive changes based on customer feedback.

U: Can you talk a bit more about that underlying infrastructure and the investment required to pull off a seamless experience?

MM: This was a significant investment for TASC—but one we knew would reap dividends far into the future. At the onset, we setup design guidelines to help us deliver on the right-touch experience. We performed usability testing to get early feedback to optimize the design. Our goal was to support virtually any number of accounts. We’ve built a platform and technology that will take us 12-15 or more years into the future, but we’ll continue to make updates. Building the UBA took multiple years, and we’re still building and adding new functions. By designing a simple, intuitive experience that focuses on how people use it rather than being rule-based, we make benefits feel like benefits again.

U: What’s on your road map now?

MM: We always stay close to the voice of our customers. We have tools in place to give our customers several ways to provide feedback, which drives our road-map priorities. For example, we have re-prioritized some features to release earlier than planned and even found a few legacy features that customers really missed, which we brought back. A road map can always change based on customer feedback and external factors including a global pandemic. TASC doesn’t react; TASC responds.

To provide the best experiences, we use technologies like cookies to store and/or access device information. Consenting to these technologies will enable us to process data such as browsing behavior or unique IDs on this site. Not consenting or withdrawing consent may adversely affect certain features and functions.